Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The world of proprietary trading firms has exploded in popularity, with hundreds of companies promising traders access to large funded accounts. While many prop firms claim to use real money and tout themselves as legitimate proprietary trading operations, the reality is more nuanced and, in many cases, different from what’s advertised.

A significant number of these firms operate using simulated accounts or demo trading environments, particularly during evaluation phases and even after funding. This practice, while not inherently problematic, often isn’t clearly communicated to aspiring traders who believe they’re trading live capital from day one.

The distinction between real and simulated trading becomes crucial when considering factors like actual market execution, slippage, and the true test of a trader’s strategies. It’s also important for traders to know have all these facts before choosing a prop firm.

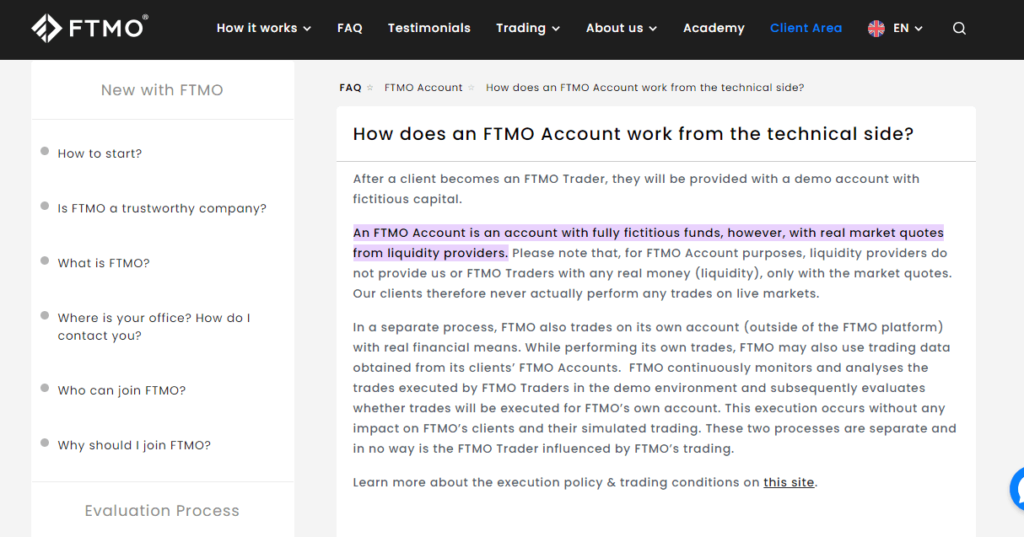

According to FTMO’s official documentation, funded traders operate on demo accounts with fictitious capital. Specifically, they state:

“An FTMO Account is an account with fully fictitious funds, however, with real market quotes from liquidity providers… Our clients therefore never actually perform any trades on live markets.”

This direct acknowledgment offers a clear window into FTMO’s operational structure and raises important questions about the nature of prop trading in today’s market.

The company’s system operates on two distinct levels, creating an interesting separation between trader activity and actual market participation. At the trader level, all activities occur in a simulated environment. While traders work with real market quotes to ensure authentic price action, their trades never touch the live market.

Meanwhile, FTMO maintains its own separate trading operations using real capital in live markets. Their statement reveals that they may use data gathered from successful traders’ activities to inform their actual market positions.

FundedNext’s communication about their use of real money is notably less transparent than some of their competitors. On their Express Evaluation page, they state: “You only prove yourself once to get access to real funds. You just need to hit the growth target at your own pace and get access to real funds. As simple as that!”

The language here warrants careful analysis. First, notice the repetitive use of “real funds” – it appears twice in close succession, seemingly emphasizing authenticity. However, this repetition and emphasis might actually serve to mask a lack of specific detail about what “real funds” truly means in practice. The phrase itself is ambiguous – does it refer to direct market access, live capital trading, or simply the ability to withdraw profits from a potentially simulated account?

E8 Funding stands out for their direct and transparent communication about their use of demo accounts. Their website explicitly states: “Please note that all accounts we provide to our clients are demo accounts with fictitious funds and any trading is in a simulated environment only.”

Unlike the ambiguous language used by some prop firms or carefully worded marketing messages about “real funds,” E8 Funding leaves no room for interpretation. Their statement breaks down into three crucial elements: they provide demo accounts, the funds are fictitious, and trading occurs in a simulated environment. This level of transparency allows traders to make informed decisions about their participation in the program.

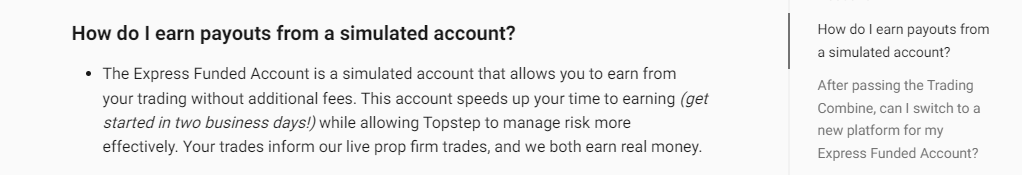

Topstep provides a refreshingly transparent explanation of their operational model. According to their statement: “The Express Funded Account is a simulated account that allows you to earn from your trading without additional fees… Your trades inform our live prop firm trades, and we both earn real money.” This detailed disclosure offers valuable insights into how modern prop firms operate.

Their explanation effectively breaks down the dual-layer structure of their business model. On one side, traders operate in a simulated environment, similar to what we’ve seen with FTMO and E8 Funding. However, Topstep takes transparency a step further by explicitly explaining how they monetize successful trading strategies – they use trader performance to inform their actual market positions.

What’s particularly noteworthy is Topstep’s practical justification for this approach. They state that simulation allows them to “manage risk more effectively” while still enabling traders to “earn from your trading.” This honest acknowledgment of risk management priorities helps explain why many prop firms prefer simulated environments over direct market access. This transparency also helps traders evaluate the pros and cons of prop trading before choosing a prop firm.

Our analysis of leading prop firms reveals a compelling pattern in the industry: most prop trading firms operate primarily through simulated trading environments, not direct market access with real capital. This revelation, while possibly surprising to newcomers, reflects the evolution of the prop trading industry in response to modern risk management needs and technological capabilities.

FTMO and E8 Funding demonstrate admirable transparency by explicitly stating their use of demo accounts and fictitious funds. Topstep takes transparency further by clearly explaining how they utilize trader performance to inform their actual market positions. In contrast, firms like FundedNext use more ambiguous language about “real funds,” highlighting the importance of careful due diligence when choosing a prop firm.

This industry-wide preference for simulation-based trading serves several practical purposes:

However, the use of demo accounts doesn’t necessarily diminish these firms’ value proposition. What matters most is:

For traders considering prop firm programs, this reality check should inform their expectations and decision-making. Success in prop trading doesn’t depend on whether you’re trading real or simulated capital, but rather on developing consistent profitability within the given framework. The key is to focus on firms that are transparent about their operations and have proven systems for rewarding successful traders, regardless of the underlying trading mechanism.

Most prop firms do not use real money. However, when choosing a prop firm, focus less on whether they offer “real money” trading and more on their transparency, reliability, and track record of paying profitable traders. After all, withdrawable profits are real regardless of whether they were generated in a live or simulated environment.

Most prop firms, particularly in the forex market, provide traders with simulated accounts rather than direct access to real capital. These firms typically mirror successful trading strategies from demo accounts in their own real-market positions. While traders don’t handle real money directly, they can earn real profits through the firm’s profit-sharing system.

Forex prop firms primarily operate using demo accounts with simulated funds, not real trading capital. The firm may use successful traders’ strategies to inform their own real-market trading decisions. This model allows firms to manage risk effectively while still providing traders with opportunities to earn real payouts.

Prop money refers to simulated capital in demo accounts where traders can execute trades without affecting real markets. Real money involves actual capital being used in live market conditions, which most forex prop firms handle separately from their traders’ accounts. The key difference lies in market execution, but both can lead to real profit payouts for successful traders.

Prop traders receive payouts based on their trading performance in simulated accounts, typically as a percentage of their profits (often ranging from 70-90%). When traders meet their targets and comply with trading rules, prop firms offer regular profit withdrawals, usually processed monthly or bi-weekly. The payout structure remains the same regardless of whether trading occurs in demo or live accounts.